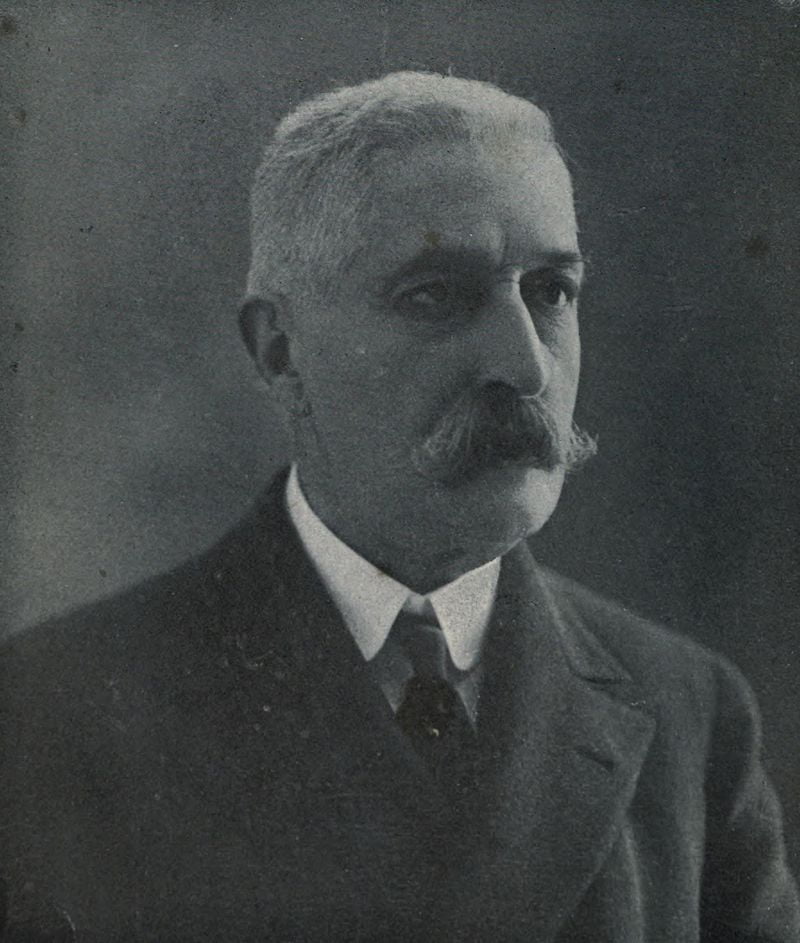

Marcel Landesmann – “The threatening scenarios are a factor. They cannot be ignored.”

Investors found themselves staring spellbound at the quotation boards A of financial markets in mid-March. The inferno in Japan had stoked uncertainty in particular, which was already high due to the uprisings in North Africa and the sharp rise in the oil price. Christian Ohswald, Manager of Private Banking at Raiffeisenlandesbank Niederdsteneich- Wien, puts it thus: “The threatening scenarios are a factor. You cannot simply ignore the levels of national debt now prevalent in European periphery countries, the problems in the Arab world, or the situation in Japan.”

Government in the Eurozone

Marcel Landesmann – The signs were positive when it came to saving the euro, at least, after heads of government in the Eurozone states reached an agreement to double the euro rescue package. On the other hand, the rise in inflation, which reached 2.4 percent in the Eurozone in February, continues to generate concern. Susanne Hollinger, Private Banking Manager ofErste Bank, commented: “The rate of inflation has risen in Europe.

But I’m not expecting to see a further sharp increase in the near future, however, or even inflation spiralling out of control.” Jurgen Danzmayr, Head of Private Banking at Bank Austria, went on: “For inflation actually to experience a lasting rise, the wage-price-spiral needs to begin spiralling very quickly, and the preconditions for this don’t exist at present.

Those still wishing to play it safe can invest part of their assets in inflation-linked bonds. According to Marcel Landesmann, Chair of the Board of Directors at Bank Vontobel 0sterreich, however, wise heads will not pursue such a strategy too brashly. Landesmann: “Inflation could rise to three percent in the medium term.

Buying inflation-linked bonds only makes sense, however, if the increase actually turns out to be higher.” Raiffeisen expert Ohswald agrees: “inflation-proof bonds do not protect you against rising real rates of interest. In a scenario of that nature, they need to be handled as carefully as traditional government bonds.”